| |

May 19, 2015

Maker Movement Drives the Future

May 14, 2015

Insider Extra: The Next Step for Wearables: Health Care

May 12, 2015

Making Sense of IOT

May 5, 2015

A Fresh Look at Wearables

April 30, 2015

Insider Extra: The Amazing HoloLens Leap

April 28, 2015

The Device Dream Team: Large Smartphones and Thin Notebooks

April 23, 2015

Insider Extra: Mobile Sites Should Be Dead

April 21, 2015

Wearables + Connected Cars = IOT Heaven

April 14, 2015

The Future of Wearable Power Is Energy Harvesting

April 7, 2015

Twinning Is Key to Connected Devices

April 2, 2015

Insider Extra: Competing Standard Co-Existence For Wireless Charging and IOT

March 31, 2015

Riding the High-Res Tidal Wave

March 24, 2015

Smart Cars Accelerating Slowly

March 19, 2015

Insider Extra: The Future of Computing is Invisible

March 17, 2015

Smart Home Decade Dilemma

March 10, 2015

Apple Event Surprises

March 3, 2015

Flat Slab Finale?

February 26, 2015

Insider Extra: "Phablet" Impact Continues to Grow

February 24, 2015

Paying for Digital Privacy

February 19, 2015

Insider Extra: The Wire-Free PC

February 17, 2015

Whither Apple?

February 12, 2015

Insider Extra: The Real IOT Opportunity? Industry

February 10, 2015

Business Models For The Internet of Things (IOT)

February 5, 2015

Insider Extra: Is "Mobile Only" The Future?

February 3, 2015

Sexiest New Devices? PCs...

January 29, 2015

Insider Extra: iPhone Next

January 27, 2015

How Will Windows 10 Impact PCs and Tablets?

January 22, 2015

Insider Extra: Hands-On (or Heads-on) With HoloLens

January 20, 2015

Whither Windows 10?

January 15, 2015

Insider Extra: Mobile Security: The Key to a Successful BYOD Implementation

January 13, 2015

Smart Home Situation Likely To Get Worse Before It Gets Better

January 6, 2015

More Tech Predictions for 2015

December 30, 2014

Top 5 Tech Predictions for 2015

|

|

|

|

May 21, 2015

By Bob O'Donnell

Much has been written and discussed recently with regard to Internet of Things (IOT) applications, generating a great deal of interest among many potential participants in the value chain of this burgeoning area. Telco carriers, in particular, have shown a strong interest in this area and view it as a large potential opportunity for future revenue growth. Verizon, for example, has announced that it already has generated $600 million in IOT revenues and it expects the category grow at an impressive 45% annual rate. Similarly, AT&T has talked extensively about its M2M and other IOT applications.

The vast majority of the efforts by major carriers have been for industrial purposes, including fleet management for the transportation industry, package tracking, industrial equipment monitoring, building HVAC system monitoring, digital signage, and many other applications.

On the consumer side, the picture is less clear, but there are a few applications that stand out:

- Connected Car

- Connected Home

- Connected Wearables

In addition, there are some applications that involve consumers from a general usage perspective but are typically driven by businesses, such as connected health, driver monitoring and others. In many cases these applications involve subsidized business models that remove the consumer from direct payment of the service but offer some type of benefit to the consumer. For example, auto insurance companies may reward consumers who use their tracking devices with lower insurance rates if they find that they drive “responsibly”. Similar, some health care providers have started experimenting with medical device monitoring equipment that they can use to better track the status of patients and, ultimately reduce their costs. In both cases, the businesses pay for the service (and the connectivity), but consumers benefit.

In the case of Connected Car, there is a strong move by car makers to bring connectivity to their cars for multiple reasons. For consumers, the electronics in a car has become a major selling point and the ability to have Internet access for passengers as well as potentially update certain aspects of the car’s electronics (such as maps for the navigation system, or streaming content for the entertainment system) are highly valued. Only a small percentage (probably in the high single digits) of the installed base of cars feature the capability to connect to cellular networks and only a percentage of that is actually using and paying for that service. Over time, this number represents the best opportunity for carriers to tap into the IOT market for consumers as consumer expectations for connectivity in cars is bound to increase significantly.

In the case of car makers, they have been experimenting with and trying to find new business models that can help them generate ongoing revenues from their cars for a very long time. Early efforts like satellite radio, connected telematics (e.g. OnStar), etc., have proven reasonably popular with consumers and have generated modest income for the carmakers. Carmakers are also interested in connectivity solutions for the ability offer over-the-air updates to cars, similar to what Tesla Motors offers today. In addition, car makers are interested in collecting real-time diagnostic information from the cars to help them pinpoint and solve potential problems.

As a result, there’s a potential business opportunity for connected cars both from the car makers and from the car buyers. The challenge for carriers is to get their solutions integrated into cars, typically through Tier One automotive suppliers, such as Delphi. One of the many challenges in autos is that the production cycles are often several years long, so it takes significantly longer for new technologies and services to be made available to consumers. In addition, as mentioned above, car makers will likely expect a portion of the consumer’s fees to go to them to help them drive ongoing revenues, which could limit the profitability to carriers.

Another IOT solution for consumers is connected home services, such as what AT&T is offering with Digital Life. The challenge here is the investment necessary to put together a complete suite of hardware products for both home security and home automation and, most importantly, the training and staffing necessary for the numerous truck rolls, installations, repairs, etc. This business is likely better suited for cable providers and other companies who already have these types of assets. In addition, it’s highly dependent on broadband services and would need to be tied to those broadband services to succeed. While it’s theoretically possible to put together a service designed for smart home do-it-yourselfers, who buy and install their own equipment, the enormous technical and logistical challenges of achieving this vision seem difficult to overcome. In addition, the ongoing (and soon to get worse) standards battles for home control combined with the poor quality of many of the current smart home products, make this an unlikely scenario for several years. Finally, the few reasonably interesting home automation products now available do not require cellular connections, but use WiFi and a local broadband connection.

Connected wearables are another potential consumer IOT solution and have some interest for athletes and others who want to track their activities while they’re outside without their smartphones. Right now, interest in these types of broadband-connected wearables is limited, but part of that is due to the high cost and demanding power requirements of many broadband cellular radios. Given some of the lower cost and reduced power requirements for radios that are on the horizon from vendors like Qualcomm, we should see slightly higher adoption over the next few years.

One of the few areas where there has been interest in connected wearables has been in smart watches designed for small children so that parents can easily track them. However, this has only occurred in Asia and has only been with carriers that have completely subsidized the cost of the watch. Here in the US, these types of devices have little to no success as of yet.

Despite these concerns, we do believe there will be some opportunities for connected wearables because it will essentially be a very low-cost add-on and some device vendors will leverage these lower costs as a means to differentiate their product. This could particularly valuable for those people interested in constantly measuring certain health-related data (the “quantified self” movement) as well as more serious athletes.

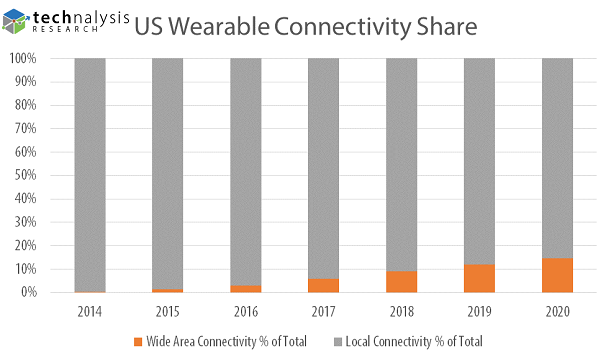

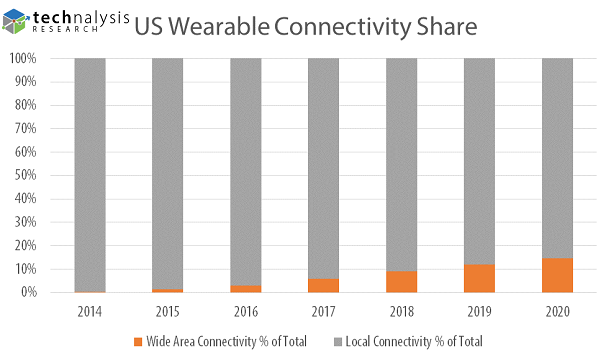

In the most recent TECHnalysis Research forecast on wearable devices, we predict that connected wearables will grow from 1% of US shipments this year to 15% by 2020. This represents a growth in units from a half million this year to 9.3 million in 2020. The chart below shows the US connected wearable forecast.

©2015, TECHnalysis Research

Though the discussion level around IOT is reaching fever pitch, we remain concerned that, other than connected car, the opportunities for consumer IOT for carriers remain relatively limited. There is some business to be had, but we believe expectations need to be kept in check.

Here's a link to the original column: https://techpinions.com/the-carrier-challenge-for-consumer-iot/40252

Podcasts

Leveraging more than 10 years of award-winning, professional radio experience, TECHnalysis Research participates in a video-based podcast called Everything Technology.

LEARN MORE |

|

Research Schedule

A list of the documents that TECHnalysis Research plans to publish in 2015 can be found here.

READ MORE |

|